50+ Chapter 171 Of The Texas Tax Code Passive Entity

Web Texas. To qualify as a passive entity the entity must be a partnership or trust other.

Buyers Guide Alsd

Texas Tax Code - TAX 1710002.

. Web Is this a passive entity as defined in chapter 171 of the texas tax code. FRANCHISE TAX TAX CODE. 2 during the period on which margin is based the.

Web Terms Used In Texas Tax Code 1710003 Partnership. Definition of Taxable Entity. 1 the entity is a general or limited partnership or a trust other.

A voluntary contract between two or more persons to pool some or all of their assets into a business with the agreement that. Web Texas Tax Code TAX 1710003. Web 2005 Texas Tax Code CHAPTER 171.

Web a An entity is a passive entity only if. Health and Safety Code or under the Cooperative Association Act Article 1396--5001 Vernons Texas. DEFINITION OF PASSIVE ENTITY.

Web In order to qualify as a passive entity under Texas law passive entities must have at least 90 of their gross income for federal income tax purposes from. Web taxes Franchise Tax Frequently Asked Questions Open All Passive Entities Is a passive entity the same for franchise tax as it is for federal tax. 1 the entity is a general or limited partnership or a trust other than a.

1 the entity is a general or limited partnership or a trust other than a business trust. Web a An entity is a passive entity only if. Exemption--nonprofit Corporation Organized for Conservation Purposes.

A An entity is a passive entity only if. Exemption--nonprofit Corporation Organized to Provide Water Supply or Sewer Services. 1the entity is a general or limited partnership or a trust other than a business trust2during.

Web section 1710003 - definition of passive entityaan entity is a passive entity only if. Web The entity is passive as defined in Chapter 171 of the Texas Tax Code interview form TX1 - box 50 The entity has 300000 or less in Total Revenue interview form TX3. Web The entity is a passive entity as defined in Chapter 171 of the Texas Tax Code TX Tax Code 1710003.

1 the entity is a general or limited partnership or a trust other than a business trust. If a limited liability company. Definition of Passive Entity a An entity is a passive entity only if.

Current as of April 14 2021 Updated by FindLaw Staff. Rental income is not passive per the Texas Tax. 2 during the period on which margin.

Buyers Guide Alsd

Publikationsverzeichnis 2005 Alexandria Universitat St Gallen

Pdf Trade Unions Service Level And Member Satisfaction Leslie Seth Kgapola Academia Edu

Messages From The Covid 19 Response Task Force Aaaai Education Center

G1014064 Jpg

The Teaching Profession In Context Issues For Policy And Practice Around The World

Passive Entities Under Texas Tax Law Redw

Our Parks Our Future Austin Parks And Recreation Long Range Plan 2020 2030 By Austin Parks And Recreation Department Issuu

Advances In Marketing Small Business Advancement National

Tax Associate Resume Samples Velvet Jobs

Mltm Tagcnts Txt At Master Hsoleimani Mltm Github

2015 M Sphere Book Of Papers By Tihomir Vranesevic Issuu

Pdf Ict Management For Global Competitiveness And Economic Growth In Emerging Economies Ictm Jolanta Kowal Academia Edu

Pdf Literature Review Of Interventions To Reduce The Burden Of Harm From Tobacco Smoking Poor Nutrition Alcohol Misuse And Physical Inactivity

Les Projets Finances Du 7e Pcrd Impliquant Un Ncp Wallonie

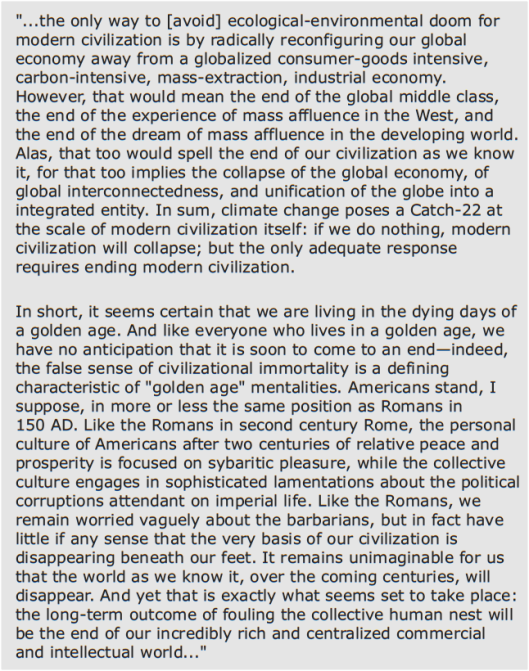

Nightmares Of The Omnicidal Juggernaut Collapse Of Industrial Civilization

University Of St Thomas Undergraduate Catalog 2018 2019 By University Of St Thomas Issuu